Bi-weekly roundup

Drew Tower project goes back to Board of Zoning Appeals, property tax revaluation coming in 2024, and tax incremental financing approved for River Parkway apartments.

→ Yesterday I predicted that the Design Review Board (DRB) would confirm—this time in writing—their original decision to approve the Drew Tower development plans that they made in January and March and that last week’s decision by the Board of Zoning Appeals to have the DRB provide this written justification for their vote shouldn’t give neighbors much hope that the development would be halted.

That is indeed what happened, but I think I still failed to really understand how the appeals process works. I had assumed that the appeal, at this point, would be over. However, the point of the DRB providing a written justification for their decision is to allow the Board of Zoning Appeals to now consider the substantive question of whether the DRB has done their due dilligence and had good reasons for its original decision. The Board of Zoning Appeals then has the option to “affirm, reverse or modify the decision of the design review board.” I am still not optimistic about the neighborhood’s chances of getting the approval overturned, but they will at least have another opportunity, likely at the next meeting of the Board of Zoning Appeals on May 26th.

→ During a Committee of the Whole meeting on May 3rd, various departments in city government presented their annual reports, including the Assessor's Office, Library, Attorney's Office, Health Department, and Finance Department. A few highlights:

The City Assessor noted that with the rapid increase in housing prices over the last several years, a city-wide revaluation will be necessary in 2024. The last revaluationwas done in 2019. This process involves re-estimating the value of every home in the city to make sure the assessed value of homes in Wauwatosa is as close to their sales price sales as possible. However, if I understood correctly, this doesn’t necessarily translate into a higher property tax bill because the city can only charge what’s needed to cover its budget, so if the budget remains the same and the value of all the homes has increased, then the tax rate should adjust downward and you end up paying roughly the same amount in taxes.

The Finance Director also mentioned—I think primarily for the benefit of the new alders—that since property taxes are the major source of revenue for the city it is also the main source of complaints from constituents:

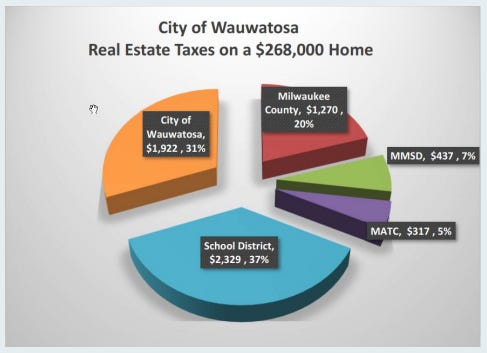

I wanted just to take a few moments to explain property taxes. Not in a lot of detail, but just something you’re likely to hear from your constituents. The first thing: if someone calls you to complain about their tax bill—because that’s probably what they’re doing if they’re calling about their property tax bill—is just to remind them that you as an alder only have control over about 30% of their bill.

Because one of the things that’s somewhat unique about Milwaukee County […] is the municipality is responsible for collecting all the property taxes for the taxing jurisdictions in their area. So when someone’s paying their property taxes at our counter, they’re not just paying for city services. They’re paying for school district services, […] they’re paying for Milwaukee Area Technical College services, and—what’s really unique in the entire country—they’re also paying for the regional sewage commission, MMSD.

So that makes it very difficult to compare their property taxes […] to their neighbor in Brookfiled which might not have that MMSD piece to their property tax bill.

The City Attorney provided this chart during his presentation:

Liability claims come from people tripping on the sidewalk, having a tree fall on their car, and a wide variety of other circumstances in which individuals think they should be compensated by the city. Regarding the large jump in liability claims between 2020 and 2021, City Attorney Alan Kesner noted:

2021 showed a really high number. The number is higher because of police related claims that came out of the protest situations that we had during the emergency order in October of 2020. They're being addressed, and we're going through it.

He also said that most of the active court cases are businesses suing the city over their tax bill. “In-house litigation matters” are cases handled by one of the two lawyers employed by the city in lieu of hiring outside council which can be expensive. Ten cases is about the maximum of what they can handle in-house.

Finally, he mentioned that due to the high rate of inflation it has become difficult for developers and construction companies to predict and account for future construction costs. This fact, coupled with the city’s increased emphasis on certain goals like increasing the availability of affordable housing, has made it increasingly difficult for the city to negotiate and structure financial incentives that encourage developers to include things like subsidized housing in their proposals. This leads into a meeting of the Financial Affairs committee in April.

→ While the detailed discussion occurred during a closed session of the Financial Affairs Committee on April 26th and wasn’t viewable, the city has completed negotions to provide additional financial assistance for a new residential building in Tax Incremental District 8 which encompasses the area on both sides of State Street from 62nd to 68th Street.

MSP Real Estate has proposed construction of the second phase of their Riverway Apartments at 6400 River Parkway. Phase 1 of the project was a 136-unit apartment and townhome project with 118 of those apartments restricted to senior citizens and 92 of those units designated as affordable (below market rate). It cost $29.75 million and the City provided $1.89 million in Tax Incremental Financing (TIF) assistance to subsidize the units with below-market-rate rents.

For Phase 2, MSP Real Estate would like to build another four story residential building with 50 additional units. Thirty-seven of those units would be affordable. This will cost $13.2 million and the developer is asking the City for $1.27 million in TIF assistance. It seems strange that they’re asking for nearly as much financial assistance for Phase 2 as they did for Phase 1, even though the Phase 2 project is only a third of the price and will have only a third as many subsidized housing units. But, it’s hard to judge without more details.

However, John Ruggini, the city’s Finance Director, did tell the Financial Affairs committee that:

This is one of our financially strongest TIFs. It’s producing an annual surplus of $600,000 dollars that remains within the TIF district. But we do have some pretty significant plans, in addition to this private development, for public spending.

Those plans include park improvements to the east of 63rd St. where the city would like to build a pedestrian and bike bridge going to Jacobus Park and another project to raise River Parkway above the floodplain and increase developable land.

The Common Council approved the TIF assistance by unanimous vote on May 3rd. Construction is expected to begin in June of this year and be completed by late summer of 2023.